In case you’re an employer with a very busy schedule, chances are you might often need to rely on your employees for handling tasks using their personal vehicles. It is at this juncture, wherein mileage reimbursement can be a smart move. If you have a large team of employees who frequently travel for work-related reasons, understanding ways to get the most out of your company’s mileage reimbursement program can be a game-changer. Below, we’ll explore the ins and outs of mileage reimbursement, its significance for your business, and the situations where it’s most effective. Let’s dive in.

What does mileage reimbursement refer to?

Mileage reimbursement is a standard practice where employers pay employees for expenses, such as fuel costs, incurred while driving for work purposes. This reimbursement is usually calculated per mile and generally falls below $1 per mile. However, the rates can vary based on Internal Revenue Service (IRS) guidelines and state laws. It’s crucial to ensure your reimbursement program adheres to these regulations to avoid legal complications.

How does it work?

To be eligible for mileage reimbursement, employees must drive on behalf of the company and maintain precise records of their business mileage and related expenses. To receive reimbursement, employees typically need to submit a mileage log or odometer readings to their employer. This log should include travel dates, starting and ending locations, and the number of miles driven. The employer then verifies the report and issues reimbursements. Mileage reimbursement can be used to compensate employees for various business-related activities, such as:

- Traveling to the bank for business transactions

- Meeting with customers

- Collecting office supplies

- Running additional business-related errands

What is the prevailing mileage reimbursement rate for 2024?

The current standard mileage reimbursement rate for 2024 is 67 cents per mile, 1.5 cents up from the 2023 rate of 65.5 cents per mile. Moving forward, the IRS is expected to announce the mileage reimbursement rate for the 2025 tax year in December of this year. This rate is applied to calculate reimbursement by multiplying it by the total number of business miles driven.

Legal jurisdictions

According to the Fair Labor Standards Act (FLSA), employers must reimburse employees for using their personal vehicles to drive company miles. Failing to do so would reduce the employee’s salary below the federal minimum wage. This requirement may not be significant for businesses where employees typically earn well above the minimum wage. However, for businesses where employees earn at or near the minimum wage, this obligation can be critical.

Perks of mileage reimbursement

For Employers:

- Cost Control: Employers can accurately budget and control expenses by reimbursing employees based on actual miles driven, rather than maintaining and managing a fleet of company vehicles.

- Tax Savings: Mileage reimbursements are often tax-deductible as a business expense, reducing taxable income for the company.

- Employee Retention: Offering mileage reimbursement can enhance job satisfaction and loyalty among employees, leading to higher retention rates.

- Compliance: By adhering to IRS guidelines on mileage reimbursement, employers ensure compliance with tax laws and labor regulations, avoiding potential legal issues.

For Employees:

- Financial Compensation: Employees are compensated for using their personal vehicles for work-related tasks, covering expenses such as gas, maintenance, and depreciation.

- Fairness: Receiving mileage reimbursement acknowledges the wear and tear on personal vehicles used for work, promoting fairness and equity among employees.

- Tax Benefits: Mileage reimbursement can be tax-free for employees if it doesn’t exceed the IRS standard mileage rate, reducing their overall tax burden.

- Job Satisfaction: Knowing that their expenses are covered through mileage reimbursement can contribute to higher job satisfaction and morale, leading to increased engagement and performance.

How to simplify mileage reimbursement?

- Integrate your mileage tracking with an expense management software:

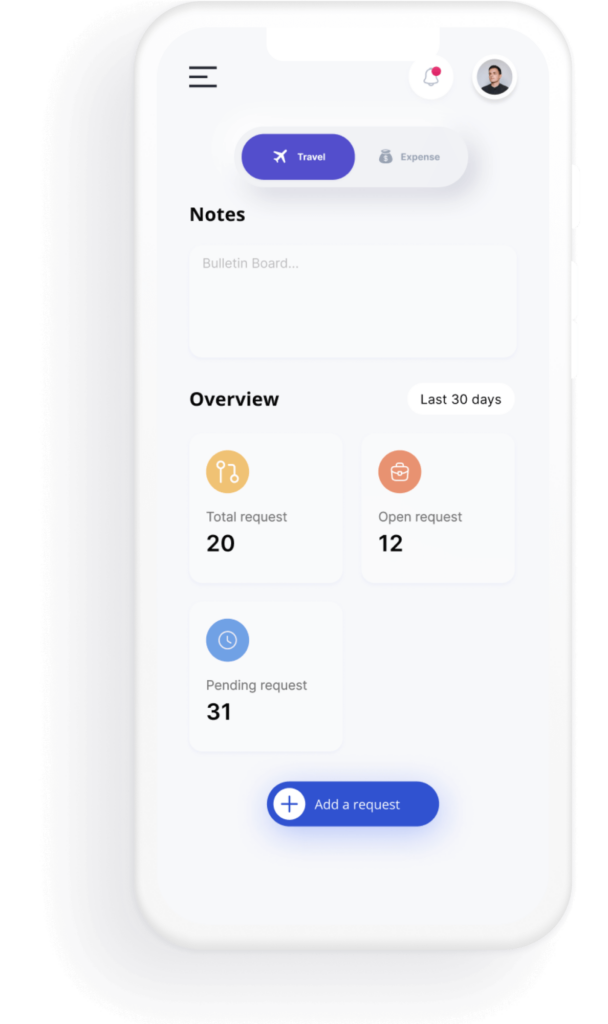

Today, several businesses use software to manage expenses. Such an approach simplifies mileage reimbursement submissions and tracking, consolidating all business expenses into a unified system. This is where Costen struts into the runway. Being a top-tier corporate travel and expense management software, Costen automates the entire process. Besides ensuring accuracy for MSMEs, it also offers enhanced oversight of travel expenses, adherence to accounting rules, and instant visibility into travel expenditures. This empowers your team to streamline operations, freeing them to concentrate on essential duties and boosting productivity for your business.

- Establish a clear mileage reimbursement policy:

Clarity in your reimbursement policy is crucial for transparency and equity. Define eligible expenses, adhere to IRS guidelines, outline the reimbursement process, and set timelines for submissions.

Takeaway

Optimizing mileage reimbursement isn’t just about saving costs—it’s about empowering your team with fair compensation, boosting morale, and fostering a culture of efficiency and trust. By implementing a transparent and efficient mileage reimbursement policy, you not only ensure financial fairness but also demonstrate your commitment to supporting your employees’ journey towards success.