Whether you’re an employee racking up miles or a company managing expenses, the new business mileage rate 2024 will directly impact your bottom line. This subtle shift with effects on reimbursement costs, budgeting, and policy adjustments are anything but negligible. Let’s delve into how this change can shape your travel and expense management particularly in the United States and what you can do to stay ahead of the curve.

Key Changes in the US Business Mileage Rate 2024

The Internal Revenue Service (IRS) has announced the 2024 mileage rates for calculating deductible costs related to operating a vehicle for business, charitable, medical, or moving purposes.

Starting on January 1, 2024, the standard mileage rates will be:

- 67 cents per mile for business use, an increase of 1.5 cents.

- 21 cents per mile for medical or moving purposes for qualified active-duty Armed Forces members, down by 1 cent.

- 14 cents per mile for charitable service, a rate set by law and unchanged. These rates apply to electric, hybrid-electric, gasoline, and diesel vehicles.

The business mileage rate 2024 has been determined based on a study of the fixed and variable costs of operating a vehicle, while the medical and moving rates are based on variable costs. Additionally, Notice 2024-08 includes the optional 2024 standard mileage rates, the maximum automobile cost for calculating allowances under a fixed and variable rate (FAVR) plan, and the maximum fair market value of employer-provided vehicles for personal use in 2024. This may be used under the fleet-average or vehicle cents-per-mile valuation rules.

It’s important to note that due to the Tax Cuts and Jobs Act, taxpayers cannot deduct unreimbursed employee travel expenses or moving expenses, except for active-duty Armed Forces members relocating under orders. Taxpayers may choose to calculate the actual costs of vehicle use instead of applying the standard mileage rates. Generally, if the standard mileage rate is chosen in the first year of business use, it can be used in subsequent years, or actual expenses can be calculated. Leased vehicles must use the standard mileage rate method for the entire lease term, including renewals, if this method is chosen.

Impact of Business Mileage Rate 2024 on Travel Expense Management

1. Increased Reimbursement Costs

The slight increase in the mileage rate for 2024 means that companies will need to allocate more funds for reimbursing employees who use their personal vehicles for business purposes. For organizations with a large mobile workforce, this can lead to higher overall travel expenses, necessitating adjustments in budgeting and expense forecasting.

2. Impact on Employee Compensation

The higher mileage rate provides better compensation for employees, covering more of their actual vehicle-related expenses. While this is beneficial for employees, it can also encourage more frequent claims for mileage reimbursement, potentially increasing the administrative burden on the company’s finance department.

3. Tax Implications

The mileage rate directly affects the amount companies can deduct as a business expense on their taxes. A higher mileage rate means larger deductions, which could reduce taxable income. However, businesses need to ensure meticulous record-keeping to comply with tax regulations and avoid potential issues during audits.

4. Budgeting and Financial Planning

Businesses may need to revisit their travel expense policies to align with the new mileage rate. This might include setting limits on reimbursable miles, encouraging alternative travel methods, or negotiating fuel-efficient vehicle use. Effective planning can help control costs while still providing fair compensation to employees.

5. Reviewing and Updating Policies

With the updated business mileage rate 2024, companies should consider reviewing and updating their travel reimbursement policies. This includes clear communication to employees about any changes and ensuring that the new policies are implemented consistently across the organization.

6. Encouraging Efficient Travel Practices

The increase in the mileage rate could lead to a reevaluation of how business travel is conducted. Companies might encourage employees to carpool, use more fuel-efficient vehicles, or consider alternatives like virtual meetings when possible, all of which can help reduce the number of miles driven and, consequently, overall travel expenses.

7. Employee Behavior and Compliance

The updated business mileage rate 2024 might influence employee behavior, leading to more meticulous tracking and reporting of business miles driven. Businesses need to ensure compliance with company policies to prevent potential abuses, such as over-reporting mileage.

Automate Business Mileage Tracking and Travel Expense with Costen

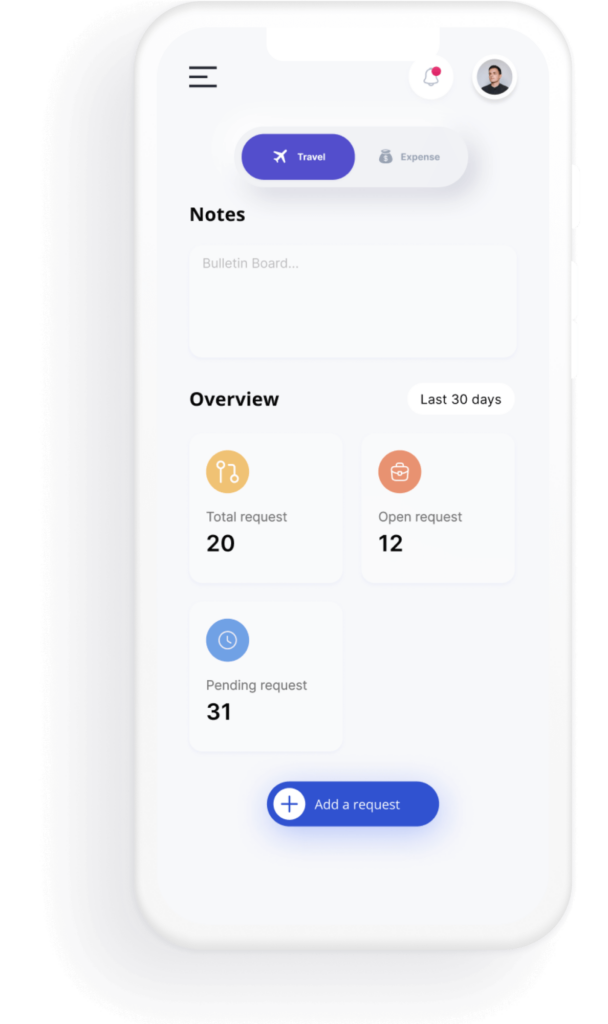

Tired of the hassle of tracking business mileage and managing travel expenses? Let Costen’s corporate travel and expense management software take the reins. With real-time data and user-friendly features, Costen helps businesses control costs and improve compliance. Enjoy accurate reimbursements, save time, and gain control—all while staying compliant with ease. By utilizing travel and expense management automation, Costen takes the headache out of mileage tracking and expense reporting. It’s more like having a personal assistant for expenses right at your fingertips.

Takeaway

The business mileage rate 2024 introduces a subtle yet impactful change in how businesses manage travel expenses. By understanding and adapting to the new rate, companies can ensure accurate reimbursements, optimize their travel expense management, and keep their financial strategies aligned with current regulations. Embracing these adjustments proactively are expected to benefit businesses for staying ahead in the game and manage their travel budgets effectively.