A billing statement outlines the financial interactions between a customer and a company for a given time frame. It lists all transactions, including purchases, payments, fees, and interest accrued during that period. Knowing how to read a billing statement is important for making correct payments, preventing overpayment/underpayment, and keeping track of expenses while checking for any mistakes in the account. But in case, you’re struggling to keep track of your billing statements, bid adieu to clutter and confusion with these smart strategies listed below.

Understanding the Terminology of Billing Statements

- Payment terms: The rules regarding when and how the balance should be paid, including the due date, minimum amount, and any penalties for late payments.

- Late payment fees: The extra costs incurred if a payment is not made by the due date.

- Minimum payment: The smallest amount that must be paid by the due date to avoid penalties and keep the account in good standing.

- Credit limit: The highest amount of credit available to the customer on the account.

- Annual percentage rate (APR): The yearly interest rate applied to the outstanding balance.

Ways to Organize your Billing Statements

Make a List

Start by listing all your bills—utilities, credit cards, rent or mortgage payments, and any other loans—in a centralized place. Whether it’s an app, spreadsheet, or a simple notebook, having everything documented ensures you can track payments and use it as a monthly checklist. This list can also form the basis of a budget if you’re looking to manage expenses more effectively.

Create Bill-Paying Spaces

Designate specific areas, both physical and digital, to store your billing statements. Organizing them this way makes it easier to find and refer back to bills when it’s time to pay. Keeping both hard copies and digital records accessible streamlines your bill management process.

Check Your Statements

Always open and review your bills promptly. Avoid the temptation to postpone reviewing them, as this could lead to late fees or missed payments. Regularly checking your statements ensures accuracy and helps you catch any unexpected charges or rate increases early on.

Review Due Dates

Note down due dates on a calendar, especially if they vary throughout the month. If due dates clash with low cash flow periods, consider contacting bill collectors to adjust due dates to better align with your financial situation.

Schedule Bill-Paying Time

Set a regular schedule to sit down and pay your bills, whether it’s once a month, bi-weekly, or more frequently. Consistency ensures billing statements are paid on time and reduces the risk of forgetting or overlooking payments.

Streamline Payment Processes

Automate bill payments wherever possible. Many banks offer automatic payment options, or billers can deduct payments directly from your account. Automation simplifies the bill-paying process, ensuring bills are paid promptly without manual intervention.

Stay Vigilant

Even with automated payments, remain attentive. Monitor transactions to verify accuracy and ensure sufficient funds are available. Promptly address any discrepancies, such as overcharges or incorrect amounts, to maintain financial control. By implementing the above-listed approaches to managing your billing statements, you’ll establish a reliable system that supports timely payments and effective financial oversight month after month

Takeaway

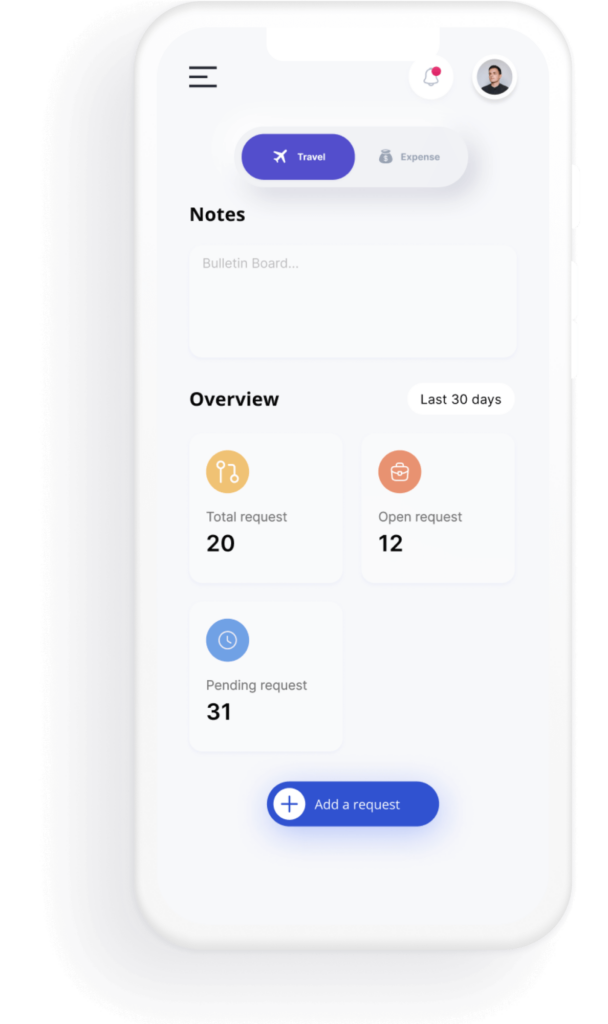

Bear in mind, when organizing your bills, choosing the right software can be crucial. Some software options promise to streamline finances but may be overly complex for everyday use. Ideally, expense organization platforms should be user-friendly and straightforward. So, in case you want to manage your expenses better without any hassle, utilize our expertise through Costen – the ultimate corporate travel and expense management software. It streamlines the entire process from submission to approval, digitizing receipts and integrating smoothly with existing accounting systems. Costen ensures accuracy for MSMEs and optimizes overall expense management. Reach out to us and stay ahead of the curve!