A petty cash fund is a small reserve of company money, used to cover minor or incidental expenses like office supplies or employee reimbursements. This fund is subject to regular reconciliations, and its transactions are recorded in the financial statements. In larger organizations, each department might maintain its own petty cash fund. Here’s everything you need to know about petty cash, its role in business operations and how to manage it.

Understanding petty cash

Petty cash is a convenient solution for minor transactions where issuing a cheque or using a corporate credit card is impractical. A designated custodian oversees the petty cash fund, ensuring compliance with petty cash rules and regulations, requesting replenishments, and dispensing funds as needed. This fund is used for expenses such as:

- Office supplies

- Customer cards

- Flowers

- Catering for small employee gatherings

- Reimbursing employees for small work-related expenses

Different kinds of petty cash

- General petty cash:

Funds allocated for minor, miscellaneous expenses, commonly used for office supplies, postage, and small employee reimbursements.

- Imprest petty cash:

A set amount of money that is regularly replenished. An example includes funds reserved to reimburse employees for business travel expenses.

- Discretionary petty cash:

Funds available for a manager or supervisor to use at their discretion.

- Emergency petty cash:

Money reserved specifically for emergency situations.

How to record petty cash in business operations?

Step 1: Develop petty cash policies and procedures

Establishing a petty cash fund can greatly benefit your organization by expediting the reimbursement process and preventing employees from using their own money for minor expenses. To ensure the effective use of your petty cash fund, it’s crucial to establish a set of policies and best practices that employees must adhere to.

- Create a comprehensive list of allowable expenses that can be covered by the petty cash fund, such as postage, office supplies, and parking fees. Additionally, set a spending limit for these expenses to prevent misuse.

- Designate a petty cash custodian responsible for managing and fairly distributing petty cash. This individual will also be accountable for the security of the petty cash box and the receipts.

- Determine an appropriate petty cash fund balance based on your company’s needs. Establish a reimbursement limit to prevent excessive spending and cash leakage.

Step 2: Secure the petty cash

After obtaining the petty cash, the custodian should store it in a locked box. Only the custodian should have access to this box, which will contain both cash and receipts.

Step 3: Reimburse and Record Transactions

Require employees to submit receipts for reimbursement, then lock the receipts in the box and record each expense in the petty cash log. The log should include:

- Date: Date of reimbursement

- Reference Number: Receipt number (if available)

- Payee: Employee requesting reimbursement

- Description: Brief explanation of the expense

- Amount: Total amount to be reimbursed

Step 4: Reconcile Continuously

The petty cash custodian must reconcile the cash whenever it is replenished, typically on a weekly or monthly basis. The reconciliation process involves ensuring that the total receipts and remaining cash match the original petty cash amount.

Step 5: Maintain the petty cash log

The custodian should summarize the petty cash log by expense account monthly or whenever cash is needed. This involves recording a journal entry that debits each expense and credits petty cash. The log should reflect:

- Beginning Balance: Initial petty cash fund balance

- Total Expenses: Sum of all petty cash expenses

- Ending Balance: Difference between the beginning balance and total expenses

Step 6: Replenish the cash

To replenish the petty cash, transfer cash from the account after recording all expenses in the books.

How to reconcile petty cash in business operations?

- Petty cash must be reconciled regularly to ensure the fund’s accuracy. When the petty cash balance drops to a predetermined level, the custodian will request additional funds from the cashier. During this process, the total amount of receipts is calculated to confirm it matches the amount disbursed from petty cash.

- When replenishing the fund, the cashier writes a new cheque and submits the receipts for the expenses that depleted the cash. The reconciliation process ensures that the remaining balance in the petty cash fund equals the original amount minus the expenses documented on the receipts and invoices.

- If the remaining balance is less than expected, it indicates a shortage, while a higher balance indicates an overage. Discrepancies often arise from expense fraud, missing receipts, or other issues. Implementing stricter internal controls can help prevent these discrepancies.

Takeaway

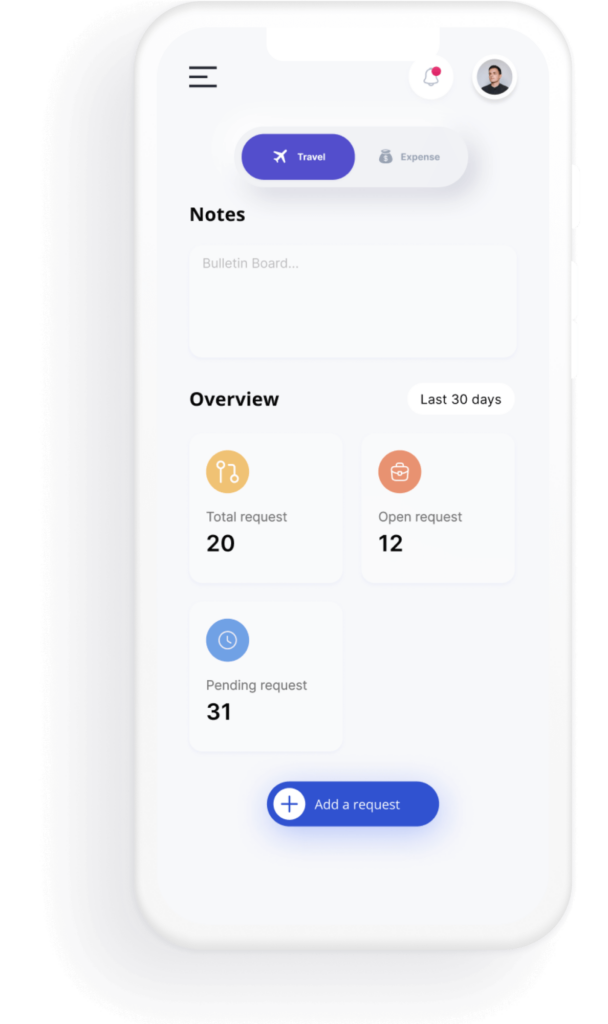

In case you want to manage your expenses better without any hassle, utilize our expertise through Costen – the ultimate corporate travel and expense management software. Costen transforms expense reconciliation in business operations through advanced automation and real-time tracking. It streamlines the entire process from submission to approval, digitizing receipts and integrating smoothly with existing accounting systems. Costen ensures accuracy for MSMEs and optimizes overall expense management. Contact us now to stay ahead of the curve!