Expense reimbursement is a common financial procedure that every company must manage, yet it often feels burdensome. Employees find it tedious, especially after returning from business trips, as they dislike filling out forms. The finance team dedicates significant time to verifying data, processing claims, approving them, and reimbursing employees. However, it’s crucial for businesses to manage this process efficiently. Below, we’ll cover the best practices of employee expense reimbursement to streamline expense management, at ease.

Understanding employee expense reimbursement

Employee expense reimbursement refers to the common business practice where employers compensate their employees for various business-related costs. These expenses typically include:

- Travel expenses for business purposes

- Meals and entertainment during business activities

- Use of personal vehicles for business needs

- Purchase of tools and supplies necessary for work

- Educational expenses and professional membership dues

Rather than handling employee expense reimbursements on a case-by-case basis as expenses arise, it is advisable for companies to establish a clear reimbursement policy. This policy should outline which expenses are eligible for reimbursement and provide guidance on the reimbursement process. This may involve submitting receipts or using an online reimbursement form. A well-crafted reimbursement policy not only streamlines the process but also helps maximize tax benefits for both employees and employers related to expense reimbursements.

Kinds of employee expense reimbursement

Travel and Mileage Reimbursements:

Businesses typically reimburse employees for expenses related to business travel, such as airfare and accommodation, which are often booked in advance. Additional expenses like taxis and meals incurred during the trip may also be reimbursed, usually through a per diem allowance. Employees can also claim mileage reimbursements for using their personal vehicles for business purposes, such as attending meetings or events within the same city.

Business Expense Reimbursements:

Employees may incur expenses directly related to their job duties, such as purchasing office supplies, meals with clients, or attending training programs. These expenses are considered business-related and are eligible for reimbursement. They are typically treated as non-taxable benefits for the employee.

Healthcare Reimbursements:

Organizations often provide employee benefits like Health Reimbursement Accounts (HRA) or Flexible Spending Accounts (FSA), which are designed to reimburse employees for medical expenses. These benefits are usually employer-funded and offer tax advantages, allowing reimbursement for medical treatments, health insurance premiums, and other qualified medical expenses.

Best practices for managing employee expense reimbursements

Establish Clear Guidelines and Expense Policies

Begin by defining which employee expenses qualify for reimbursement. Eligible expenses typically include air travel for company events, lodging, meals, office supplies, training courses, subscription fees, and business travel mileage. Inform employees of the reimbursement process, let them to retain receipts, and establish deadlines for submissions. Collaborate closely with your bookkeeper to accurately record and process reimbursements, ensuring financial accuracy.

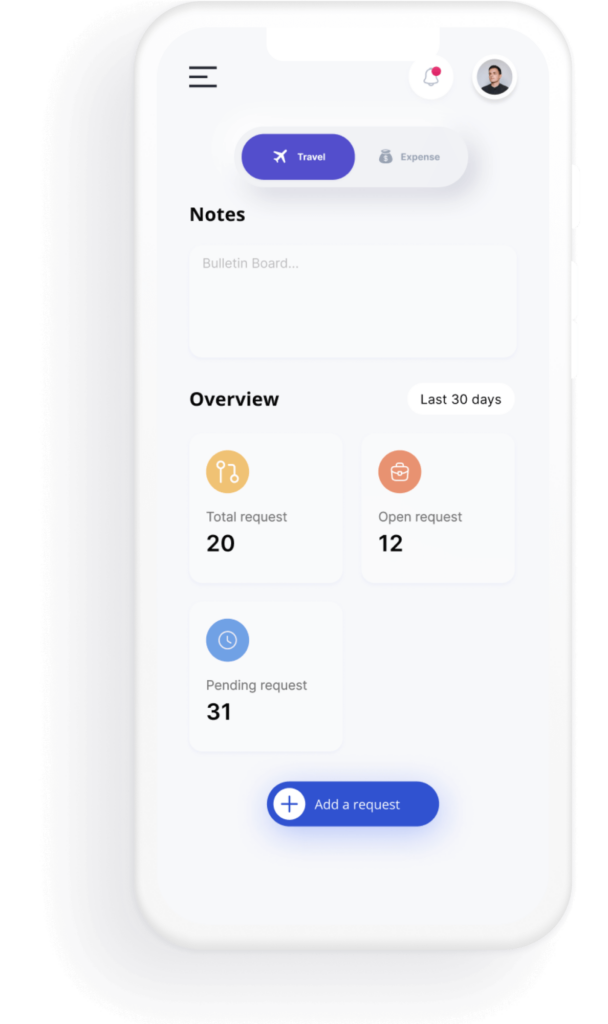

Implement an Online Expense Submission and Approval System

Introduce an online platform for collecting, storing, and approving employee expenses. These systems enhance transparency by providing access to receipts and submission dates. They also include approval functionalities, enabling managers to efficiently review and authorize reimbursement requests.

Establish a Budgeting and Monitoring System

Incorporate employee expenses into your financial planning to monitor adherence to budgetary expectations. Promptly address any budget overruns by implementing stricter approval processes and enhancing managerial oversight to maintain optimal cash flow.

Maintain Regular Communication with Employees

Ensure clarity by documenting the expense reimbursement policy and making it accessible to all employees, possibly through your company intranet. Integrated reimbursement systems facilitate ongoing communication, allowing employees to track the status of their reimbursement requests and anticipate payment dates.

Conduct Routine Audits

Regularly audit employee expenses to verify compliance with reimbursement policies. Review sample expenditures to confirm they are supported by appropriate documentation and accurately reimbursed. Lastly, prepare your financial records for year-end closing and tax reporting.

Takeaway

For seamless expense management, consider utilizing our expertise through Costen – an advanced corporate travel and expense management software. Costen revolutionizes expense reconciliation in business operations with automation and real-time tracking. It simplifies the entire workflow from submission to approval by digitizing receipts and seamlessly integrating with your current accounting systems. It guarantees hassle-free precision for MSMEs and enhances overall expense management efficiency. Reach out to us today and stay at the forefront of innovation!