Ever wondered how businesses keep their finances in check? The answer lies in two words: expense reconciliation. It’s the process that ensures every dollar is tracked, anomalies are spotted, and financial integrity is maintained. In this guide, we’ll explain what expense reconciliation is, why it’s crucial for businesses, and the key steps involved.

What does Expense Reconciliation refer to?

Expense reconciliation is a critical finance and accounting process that ensures a company’s financial records accurately reflect its spending. Essentially, it involves comparing financial data from different sources within the business to identify and correct any discrepancies or errors. In simpler terms, expense reconciliation is like double-checking financial records to ensure everything aligns correctly. Similar to balancing a checkbook or matching receipts to your monthly bank statement, this process helps businesses ensure all expenses are properly recorded.

Expense reconciliation involves reviewing transactions, invoices, receipts, and other financial documents to verify they match the company’s records and budget. This comparison helps identify discrepancies such as missing or duplicate transactions, incorrect amounts, or unauthorized expenses. Such a process provides a clear and accurate picture of a business’s spending habits and financial health, enabling better budget management, informed decision-making, and effective business management.

Why is Expense Reconciliation needed?

- Meeting Compliance and Regulatory Standards

Expense reconciliation is vital for adhering to financial regulations and industry standards. By reconciling expenses, businesses can ensure compliance, avoiding potential penalties and legal issues.

- Preventing Fraud

Thorough expense reconciliation is a critical tool in fraud prevention. By meticulously reviewing financial transactions and spotting irregularities, businesses can detect and prevent fraudulent activities, protecting their assets and reputation.

- Ensuring Financial Accuracy

Expense reconciliation is essential for maintaining accurate financial records. By comparing and verifying expenses, businesses can identify and correct discrepancies, ensuring their financial statements accurately reflect their true financial status.

- Managing Budgets Effectively

Expense reconciliation provides valuable insights into spending patterns, aiding in effective budget management. By tracking expenses and identifying areas of overspending, businesses can make informed decisions to optimize budget allocation and improve financial performance.

Step-by-Step Guide to Effective Expense Reconciliation

Expense reconciliation is a structured process designed to ensure the accuracy and consistency of financial transactions. Here’s a detailed guide to help you perform expense reconciliation effectively:

1. Collect Financial Documents

Gather all necessary financial documents, including bank statements, credit card statements, vendor invoices, employee expense reports, and inventory records. Ensure the data is accurate and current to aid the reconciliation process.

2. Examine Transactions

Thoroughly review each transaction in your financial records, including deposits, withdrawals, purchases, payments, and expenses. Confirm the details such as dates, amounts, descriptions, and account codes for accuracy.

3. Cross-Check Transactions

Compare the transactions in your financial records with those in external documents like bank statements, credit card statements, vendor invoices, or employee expense reports. Ensure each transaction is accurately matched and reconciled with its corresponding entry.

4. Detect Discrepancies

Identify any discrepancies or differences between the transactions recorded in your financial records and external documents. Typical discrepancies might include missing transactions, duplicate entries, incorrect amounts, or unauthorized expenses.

5. Correct Discrepancies

Take necessary actions to resolve any identified discrepancies or errors. This may involve correcting data entry mistakes, contacting vendors or financial institutions for clarification, or updating financial records to reflect accurate information.

6. Record Findings

Maintain detailed records of the reconciliation process, including the steps taken, findings, and resolutions for any discrepancies. Documentation ensures transparency, accountability, and compliance with internal policies and external regulations.

7. Implement Controls

Establish reconciliation controls and procedures to prevent future discrepancies and errors. This may include regular transaction reviews, segregation of duties, approval workflows, and periodic audits.

8. Continuous Monitoring

Regularly monitor and review the reconciliation process to ensure ongoing accuracy and effectiveness. Periodically assess the adequacy of reconciliation controls, identify areas for improvement, and make necessary adjustments to enhance the process’s efficiency and reliability.

Takeaway

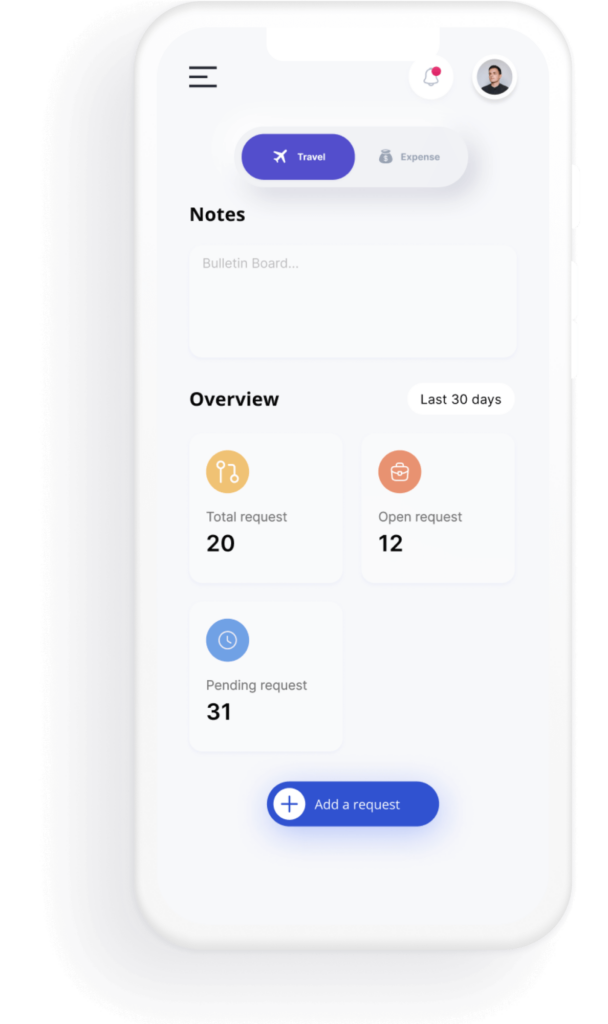

Expense reconciliation has become way more complex with increasing transaction volumes. To boost efficiency, businesses need to utilize technology – particularly automation, to streamline workflows and enforce policies. Selecting the right software, digitizing receipts, integrating with legacy accounting systems, and ensuring compliance are some of the initial go-to steps. Wondering how to streamline accounts payable and automate expenses better? Utilize our expertise through Costen – the ultimate corporate travel and expense management software. Costen revolutionizes expense reconciliation by integrating advanced automation and real-time tracking capabilities. What Costen does is, it simplifies the entire process starting from submission to approval. By digitizing receipts and seamlessly integrating with existing accounting systems, Costen not only ensures accuracy for MSMEs but the whole of expense management in its entirety. So, wait no longer – reach out to us and get ahead of the game already!