Navigating the world of business travel expenses can feel like driving through a maze of rules and receipts. One of the most common questions that pops up on this journey is, “does mileage reimbursement include gas?” It’s a fair question—after all, fuel is a key player in any road trip, whether it’s a cross-country drive or just a quick jaunt to a client meeting. In this article, we’ll dive into the ins and outs of mileage reimbursement to clear the air on what your business really covers when it comes to taking the road.

Understanding Mileage Reimbursement

Mileage reimbursement is a kind of payment made to employees for the business use of their personal vehicles. The reimbursement typically covers the costs associated with operating the vehicle, such as fuel, maintenance, insurance, depreciation, and other related expenses. This compensation is usually calculated based on a per-mile rate, which is set by the employer or follows guidelines like those issued by the Internal Revenue Service (IRS) in the United States.

Does Mileage Reimbursement Include Gas?

The short answer is: yes. Fuel is one of the most apparent expenses when using a personal vehicle for work. Therefore, mileage rates need to factor in fuel costs. However, two challenges arise: fluctuating fuel prices due to time and location and varying fuel efficiency across different vehicles.

If fuel prices balance out over the year, it typically isn’t an issue for the mileage rate. However, if there are significant spikes or drops, your organization might need to consider adjusting the rate accordingly. Additionally, there’s the disparity between drivers in states with high fuel costs, such as California, and those in states with lower fuel prices, like South Carolina or Texas.

But remember, mileage reimbursement rates are designed to cover more than just gas; they are meant to compensate for the overall cost of operating a vehicle. This includes gas, oil changes, tire wear, insurance, and depreciation of the vehicle. So, when employees receive mileage reimbursement, they are being compensated for gas and a variety of other vehicle-related expenses, all wrapped into a single per-mile rate.

What Other Costs Are Covered by Mileage Reimbursement?

Mileage reimbursement includes several direct expenses related to vehicle use, such as tires, oil, and maintenance. The more frequently a vehicle is used, the more often these components need to be replaced or serviced. Since mileage rates are based on the distance driven, they effectively cover these routine maintenance costs.

However, mileage reimbursement also accounts for less obvious expenses like taxes, license fees, registration, and vehicle depreciation. While these costs should be reimbursed in proportion to vehicle use for work, they are often less dependent on mileage and more related to the vehicle’s age, size, and value. Consequently, drivers with lower mileage may find that their reimbursement does not fully cover these ownership-related expenses.

Key Considerations for Businesses

Reimbursement Rate Coverage:

Mileage reimbursement rates are designed to cover a range of expenses, including gas, maintenance, insurance, and depreciation. It’s crucial to set a rate that adequately compensates employees for all these costs, including fuel.

Fluctuating Fuel Prices:

Prices of fuel or gas can vary significantly over time and between locations. Businesses should be prepared to adjust the reimbursement rate in response to significant fluctuations in fuel costs to ensure employees are fairly compensated.

Documentation and Transparency:

Clear documentation and transparency in mileage reimbursement policies are crucial, especially when addressing common questions like “does mileage reimbursement include gas?” By providing detailed information on what’s covered and what’s not, businesses can prevent misunderstandings and ensure accurate reimbursement.

Adjustments for High and Low Mileage:

Mileage reimbursement may not fully cover ownership costs for low-mileage drivers, as these costs are fixed and not directly proportional to the amount of driving. Businesses should consider this when setting rates and reviewing expense policies.

Takeaway

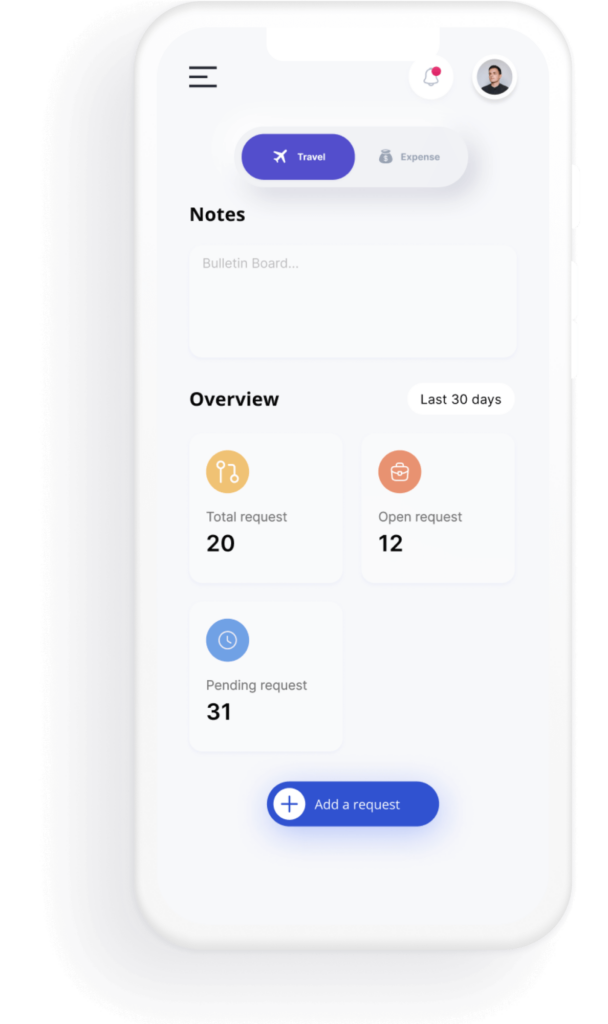

So, does mileage reimbursement include gas? Yes, but remember it’s a part of a larger package designed to cover the total cost of using a personal vehicle. For businesses, mastering mileage reimbursement is essential for smooth expense reconciliation. With the right corporate travel and expense management software like Costen, you can turn travel expenses from a tangled mess into a streamlined system anyday. Follow the guidelines, keep your records crystal clear, and watch as your expense management goes from confusing to uncomplicated, keeping everything on track and compliant.