Digital receipts are here to transform travel and expense management from a chaotic mess into a smooth, organized process. Imagine swapping out stacks of crumpled receipts for a sleek digital system that effortlessly tracks and manages every expense. It’s like having a personal assistant who never sleeps, never loses receipts, and always keeps your finances in perfect order. Ready to make your expense management a breeze? Dive into the world of digital receipts and watch your business’s financial chaos turn into clarity.

What are Digital Receipts?

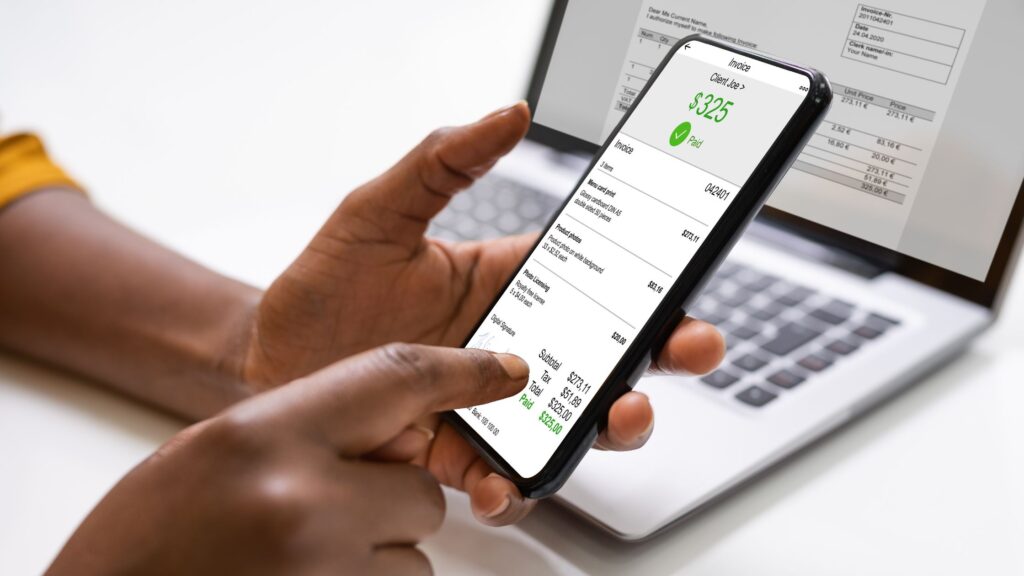

Digital receipts are electronic records of transactions that capture and store purchase details in a digital format rather than on paper. They can be generated in various ways, such as through email confirmations from online or in-store purchases, scanned images of physical receipts, or directly created by financial software applications. These digital records include crucial information like the date, amount, vendor, and description of the transaction.

Unlike traditional paper receipts, digital receipts are easily accessible and retrievable from any device with internet access. They enhance accuracy by reducing the risk of loss, damage, and manual entry errors. Moreover, digital receipt systems often integrate with expense management tools, automating the tracking, categorization, and reconciliation of expenses. This integration not only streamlines the expense management process but also helps in maintaining precise financial records and improving overall administrative efficiency.

Problems of Manual T&E Management

1. Inaccuracy

Manual travel and expense (T&E) management often suffers from significant inaccuracies due to the inherent challenges of handling physical receipts and manual processes. The process typically begins with the collection of physical receipts, which must be manually extracted and entered into a spreadsheet or document. This manual entry is not only time-consuming but also prone to human error.

The result is a cumbersome and error-prone workflow that places an undue burden on finance teams. They are forced to invest significant time and effort in correcting inaccuracies and reconciling discrepancies, which can lead to delays in financial reporting and potential compliance issues. The lack of accuracy and efficiency in manual T&E management underscores the need for more automated solutions that can streamline these processes and reduce the risk of errors.

2. Data Errors

Manual travel and expense (T&E) management is highly susceptible to data errors due to its reliance on significant human involvement. The manual nature of this process makes it easy for inaccuracies to arise at various stages, from data entry to expense reporting. Manual processes are prone to incorrect calculations, leading to discrepancies between reported amounts and actual expenses. These errors can significantly impact financial records, leading to inaccurate reporting and potential issues with budgeting and forecasting. The prevalence of these errors underscores the need for automated systems that can reduce human involvement and increase the accuracy of T&E management.

3. Delayed Reimbursement

Traditional management of business expenses demands time, effort, and attention, which often leads to delays in reimbursements. Relying on physical receipts means that any discrepancies, misplacement, or damage to these documents can set back the reimbursement process by hours or even days.

4. Manual Verification of Every Receipt

Traditional modes of expense reconciliation and reporting are not only time-consuming but also labor-intensive. Additional staff may be needed to handle the workload, and these employees are often tied up with tedious administrative tasks. For small businesses, this can be particularly harmful, as it drains valuable resources.

5. Time-Consuming

The manual review, reconciliation, and approval of expense management reports demand a considerable investment of time and effort. Each expense report must undergo a thorough examination, where every individual expense is vetted to ensure its accuracy and compliance with company policies. This process involves matching each reported expense with its corresponding physical receipt, which requires careful scrutiny to confirm that the documentation supports the claimed amounts.

In cases where receipts are lost, illegible, or otherwise compromised, additional time is required to resolve these issues. Finance teams may need to request duplicate receipts from employees, engage in extensive communication to clarify discrepancies, or even conduct additional investigations to validate the expenses. Each of these steps adds to the overall time required to complete the review process.

Benefits of Digital Receipts

1. Reduce Human Errors

Managing business expenses with digital receipts significantly lowers the risk of human errors. Information from receipts is captured and stored digitally in a secure online database, accessible anytime, anywhere. You no longer need to worry about misplaced, damaged, or incomplete receipts or mismanaged data.

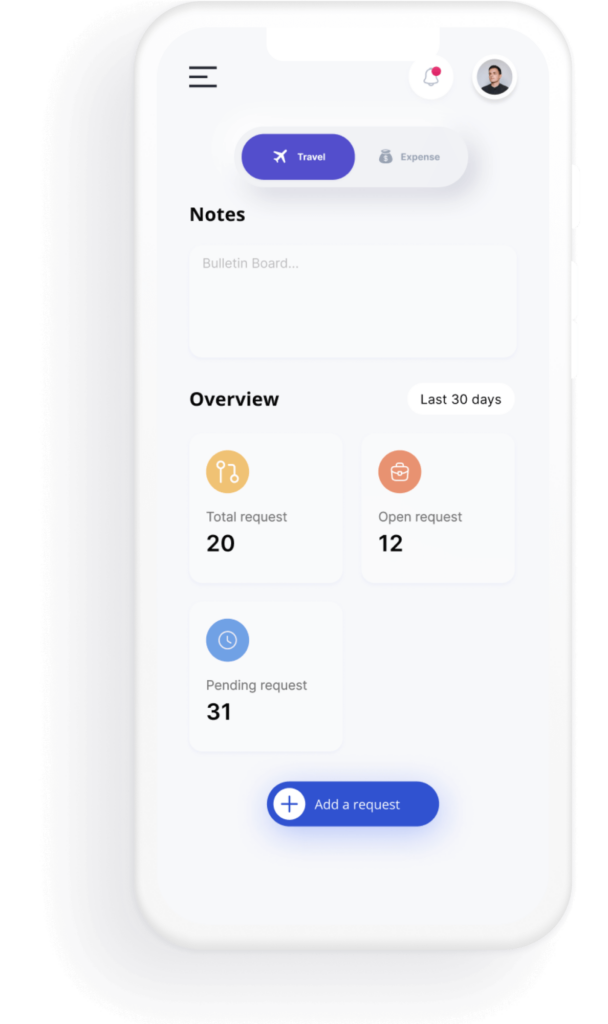

2. Save Time

Time is crucial in expense management, be it large or small businesses. Digital receipts streamline the process by eliminating most manual steps involved in reporting. Employees save time as they don’t need to submit forms or receipts manually. With an efficient corporate travel and expense management software like Costen, managing outlays is a breeze. It swiftly handles expense recording and billing statements, saving your valuable time and effort.

3. Track Every Single Transaction

Digital receipts capture every single transaction, providing a detailed and transparent record of employee spending. Unlike traditional paper receipts, which can be lost or mishandled, digital receipts are stored securely in an electronic format. This ensures that each expense is accurately documented, including crucial details such as the amount spent, the date of the transaction, the vendor, and the purpose of the expenditure.

4. Well-Organized Data

Digital receipts ensure that your receipts and transactions are not only recorded but also well-organized. Information is systematically sorted and compiled, providing valuable insights and analytics on spending through an expense management platform.

5. Real-Time Reports

With digital receipts, you get real-time access to your expenses. There’s no need to wait until the end of the month for reconciliation. Transactions are recorded, sorted, and categorized instantly, allowing you to monitor spending continuously.

Takeaway

Adopting digital receipts is a smart move, but using Costen to manage is even smarter. For businesses aiming to speed up processes, improve expense reconciliation, and save both time and money, Costen’s travel expense management solution is the ideal choice. Embrace digital receipts and let technology handle the details, so you can focus on what truly matters—growing your business and achieving your goals.