Non discretionary expenses are like the foundation of a house—solid, unyielding, and absolutely essential for keeping everything else intact. Unlike discretionary spending, which you can tweak or cut, non-discretionary costs are the immovable pillars of your operations. Think of them as your business’ non-negotiables: rent, salaries, utilities, and insurance. These are the expenses that keep the lights on and the wheels turning. Dive into this guide to uncover how to pinpoint these crucial costs and wield an ideal strategic management, at ease.

Ways to Identify Non Discretionary Expenses

The first step is distinguishing non discretionary expenses from discretionary ones. These expenses are necessary for maintaining the fundamental infrastructure of your business. Common non-discretionary costs include:

Rent or Mortgage Payments:

If your business operates from a physical location, rent or mortgage is a major non-discretionary expense. For example, a retail store in London’s prime shopping area will have a significant monthly rent, which remains a fixed cost regardless of sales volume.

Employee Salaries and Benefits:

Payroll for full-time employees is another non-discretionary commitment. In industries such as healthcare or manufacturing, skilled labor costs are fixed because cutting staff would directly affect operational capacity and quality.

Utilities:

Electricity, water, and internet services are non-negotiable, particularly for industries that rely on constant power and connectivity, like data centers or manufacturing plants.

Insurance:

Businesses in sectors like construction, logistics, and retail are required by law to carry insurance (e.g., liability insurance), which constitutes a significant recurring expense.

Loan Repayments:

Any outstanding loans or credit lines must be repaid according to fixed schedules. Delays or defaults can harm the business’s credit rating and result in penalties.

Ways to Manage Non Discretionary Expenses

Track Expenses in Real Time

To manage non discretionary expenses effectively, tracking them in real-time is essential. Use reliable accounting software, to track payments, due dates, and any fluctuations in costs (e.g., energy price increases). For example, a small manufacturing company can monitor its energy usage and adjust production schedules to off-peak hours, reducing utility expenses. Also, implementing robust expense reconciliation practices ensures that all non-discretionary costs, such as utility bills, are accurately matched with corresponding invoices and payments, preventing discrepancies and financial errors.

Analyze Cost Trends

Analyze the historical data of your non discretionary expenses to detect trends. For instance, insurance premiums might increase annually, while interest rates on business loans may fluctuate based on market conditions. In some cases, renegotiating contracts with service providers can yield savings. For example, a tech startup could renegotiate its office lease to secure a lower rate during an economic downturn or after proving its financial stability.

Implement Cost-Control Measures

While non discretionary expenses are essential, there are still ways to optimize and manage them:

Optimize Workforce Allocation:

For businesses with fluctuating demand, using flexible work models like hiring part-time or freelance workers can help manage payroll costs.

Energy Efficiency:

Invest in energy-efficient systems to reduce utility bills. A hotel chain that installs smart thermostats and LED lighting can reduce its non-discretionary energy expenses by a significant margin annually.

Insurance Bundling:

Consider bundling insurance policies with a single provider to reduce premiums. A logistics company can consolidate vehicle, property, and liability insurance to save on premium costs.

Plan for Future Non-Discretionary Increases

Non discretionary expenses are often subject to external factors, such as inflation or regulatory changes. For example, regulatory changes in health and safety laws can require additional insurance or compliance costs for factories. Forecasting such changes and incorporating them into your financial plans is crucial to staying ahead of these unavoidable increases.

Build Contingency Funds

Since non discretionary expenses must always be paid, even in times of financial strain, it’s vital to maintain an emergency fund. For instance, during economic downturns or off-peak seasons, a manufacturing business with a robust contingency fund will be able to cover its rent, salaries, and loan repayments without cutting critical staff or production capacity.

Takeaway

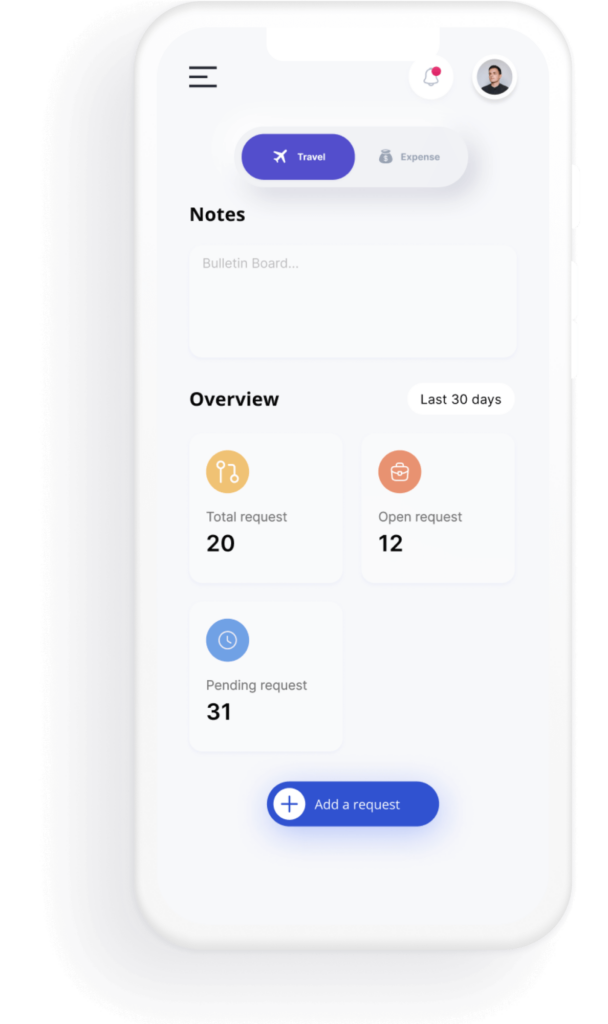

Effectively managing non discretionary expenses is like mastering a high-stakes game—understanding the fixed rules, and tracking every move wherever you can. Corporate travel and expense management software makes tracking non discretionary expenses easier. It automates reporting and approvals for businesses, streamlining fixed costs like travel costs, mileage reimbursement and many more. By pinpointing key cost drivers, negotiating better contracts, and anticipating future increases, businesses can keep their core operations running smooth without a hitch.